Did You Buy A Money Pit?

When you hear “money pit,” do you instantly think of the comedy classic starring Tom Hanks and Shelley Long? (If not, it’s worth a peek for a lot of laughs -- or maybe a cautionary tale if you’re house hunting.)

A newlywed couple buys what they believe to be the house of their dreams, only to face non-stop disasters. If this sounds like it could be the case with your newly purchased home, you might be wondering if you bought a money pit.

A house with continuous large problems that rapidly deplete your budget and patience is a money pit. Most of the time, homebuyers think they’re buying a good home and find unexpected problems lurking beneath the surface. Examples are hidden pest infestations, neglected plumbing issues that cause massive water damage, or aging features that kick the bucket soon after the purchase.

In the film, the home seems absolutely perfect when the couple signs on the dotted line. However, soon after, the frustrated couple falls into a never-ending black hole of ramshackle renovations, which take a toll on their finances and their marriage.

What Makes A House A Money Pit?

A money pit is any house that has one issue after the other and leaches massive amounts of your time, money, and peace of mind. Of course, to make a great comedy, the home problems in the film “The Money Pit” are over-the-top and zany (including Tom Hanks getting stuck inside a rug as it falls through a hole in the floor). But the concept is very much real.

In some cases, you might willingly purchase a house riddled with issues. It could be you need to move to a specific location for work and the real estate market in the area offers slim pickings.

Perhaps you use it to your advantage to get a lower asking price. However, if supply is short and demand is high, you could pay thousands more than the home is worth simply to get your foot into the neighborhood.

You May Know You’re Buying A Money Pit, But Most Of The Time It’s A Surprise

In more unfortunate cases, homebuyers purchase a home that seems solid and in good condition. They may even get a home inspection assuring them of this.

But then, after purchasing the home, problems start to pop up at every turn. Then, issues keep on coming and never seem to stop. These unlucky homebuyers are the ones who fall into the money pit instead of jumping into it knowingly.

If your money pit is a surprise, it amplifies the toll on your mental well-being and your budget. You weren’t planning to deal with these problems or expenses.

How Do You Tell If Your House Is A Money Pit?

Let’s assume you’re in the camp of people who thought you got a reasonably sound house. But now that it’s yours, you’re finding it’s not in the shape you thought it was. Is it a money pit, or does it just need a bit more TLC than you initially thought?

You could say that whether or not your home is a money pit is relative. If you have an unlimited amount of money and hire professionals to handle all the problems, maybe it’s not a big deal for you.

But if you’re like most people, multiple major problems within a short time frame means money is flying out the door faster than you can count it. If this sounds familiar, then more than likely, you’ve got a money pit.

There are a few red flags that signal you’re dealing with a money pit, and most deal with larger parts of the home. Keep in mind that in a true money pit, you would likely experience more than one of these problems.

1. Foundation Or Structural Problems

If you start spotting cracks in your foundation, or realize the floors sag, or a wall has a slight lean, these point to structural issues. Or it could be something you thought was a positive (that beautiful large tree in the yard) is a negative (the roots are too close to the foundation).

Major foundation problems or other issues that compromise the integrity of your home typically take a lot of money and time to fix. Plus, some repairs can’t wait until later. If you don’t address them as soon as possible, your whole house could come down on top of you.

2. Discovering Harmful Materials

You bought the home thinking everything was safe and ready to go. But then you discover your home hides dangerous secrets like lead paint, asbestos, radon, or mold. Anything could be lurking behind the drywall, in the attic or roof shingles, or under the ground.

Although sellers are supposed to disclose this sort of information (if they know about it), sometimes they don’t. These problems pose major health risks, so they’re also things you need to address immediately.

You also need a professional company that specializes in the removal of dangerous material. It’s another costly endeavor and one that you can’t put on the back burner.

3. Water Damage And Plumbing Problems

Any signs of water damage should send you running for the hills. Water damage usually means lots of headaches, hassle, and money to fix. And if you notice leaks, it’s a warning that you could have mold in the home, too.

Often, evidence of these types of issues means you’ll need professional remediation and could be on the hook for thousands of dollars. If the damage is from corroded or outdated plumbing, you may need to redo the plumbing for your whole home.

4. Old Roof, Windows And Insulation

Aging windows and an old roof are other expensive repairs. Your roof and your windows provide a lot of protection to you and your home from outside elements. Insulation also helps reduce heat and cold transfer between the inside and outside of your home and reduces noise.

Low or no insulation won’t just make your home uncomfortable, you’ll also see a spike in your utility bills. Therefore, these are more issues that you want to address sooner than later.

5. Aging Electrical And Mechanical Systems

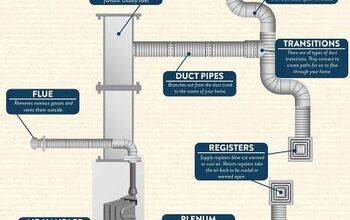

If you purchase an older home, you might discover the electrical system is significantly outdated or the HVAC system is on its last legs. If you learn all of this after you purchase the house, you’re in for some expensive repairs and replacements. Rewiring a home could cost $10,000 to over $20,000 and a new HVAC system the same, depending on the house size.

6. Pest Infestations

Damage from critters, like termites or other pests, might be from an old or active infestation. Former homeowners may have gotten rid of the bugs but left the damage untouched. Or maybe the infestation is active and they simply hoped you wouldn’t notice.

Either way, it’s a big problem. With significant infestations that run through an entire home, repairs could top $100,000. Also, in many situations, infestations pose health hazards.

What Should You Do If You Bought A Money Pit?

Are you starting to chew on your fingernails as you come to grips with the harsh reality that you own a money pit? Before you obliterate your nails, take a breath and think about your options.

- Breathe and step back to assess your situation. Sure, you’re angry and frustrated. But now you have this home and you have to decide what you’re going to do about it. Try to keep emotions out of it as you look at the reality of your situation.

- Get a professional opinion. In the heat of the moment, stress can make you feel like your entire house is falling down. But before you jump to conclusions, bring in a contractor to help you assess the damage. Find someone you trust who can give you a clearer picture of what you’re actually dealing with.

- Speak with an attorney. If you feel you were misled by the sellers, consider hiring an attorney. In most cases, sellers must disclose known issues with the house. If it’s possible to prove they knew about the problems when they sold you the property, you could get compensation. Since there may be deadlines to when you can do something, you don’t want to wait on this one.

- Prioritize the problems. Once you know what exactly is going on in your home, prioritize what needs to happen. Using a contractor’s recommendations, list out things in order of importance. (Removing dangerous materials, eliminating infestations, and making your home structurally sound are all contenders for the top of the list.)

- Gather quotes. Start with your item number one and get a few quotes from respected, recommended professionals. Keep organized records of who you speak with, when, and what they tell you.

- Take it one step at a time. Approach each issue one step at a time. Take a break now and then to reset and replenish your budget. It’s frustrating and stressful, but try to remain positive throughout the process, so stress and anger don’t get the better of you.

Don’t Fall Into A Money Pit (But Feel Free To Jump In If You Know The Risks)

A money pit isn’t always unexpected, although unfortunately, you can stumble into one if you deal with sneaky sellers, skip the home inspection, or miss red flags. If you end up in a money pit, know that there is a way out, albeit a time-consuming and costly one.

Foundation problems, structural issues, aging electrical, plumbing, and HVAC are just a few examples of the problems that can turn your new home into a money pit. If you bought what you feel is a disaster, breathe and step back to get a clearer picture of your situation.

Ask a contractor to help you assess the damage and prioritize what needs to happen first. Take things one step at a time to dig your way out of a money pit and create your home, sweet home.

Related Guides:

Stacy Randall is a wife, mother, and freelance writer from NOLA that has always had a love for DIY projects, home organization, and making spaces beautiful. Together with her husband, she has been spending the last several years lovingly renovating her grandparent's former home, making it their own and learning a lot about life along the way.

More by Stacy Randall

![12 Washing Machine Brands to Avoid [with Recall Data]](https://cdn-fastly.upgradedhome.com/media/2023/07/31/9075781/12-washing-machine-brands-to-avoid-with-recall-data.jpg?size=350x220)