Why Do I Have To Pay HOA Fees?

When you’re looking for a new home, you might come across a place you love that is part of a Homeowner Association (HOA). Maybe it features impressive amenities, like a fitness center or a pool. You know you can afford the mortgage, but don’t forget, if you buy the property, you have to pay HOA fees, too.

HOA fees cover maintenance and repairs of community areas, the neighborhood’s amenities, and municipal services. Many HOAs also include their insurance premiums in the HOA fees. This insurance covers the shared areas of the community. A portion of the fees goes into a reserve fund. The reserve fund acts as a savings account for unexpected or larger expenses.

What Are HOA Fees?

HOA fees are the dues homeowner associations charge members to cover various aspects of the community or neighborhood they live in. Homeowner Associations are nonprofits that oversee particular standards and guidelines in communities on behalf of the developer.

Typically, you’ll find HOAs in communities consisting of multiple single-family, detached houses. The residents own their homes and land, but the HOA is responsible for maintaining community amenities, like a clubhouse, pool, tennis courts, etc. Homeowners usually pay their HOA dues monthly.

What Do HOA Fees Cover?

The specifics of what your HOA fees cover will depend on where you live. Every HOA features unique rules and regulations, so getting a copy and familiarizing yourself with them is essential. If the rules seem too overbearing, you might want to reconsider purchasing a property within that particular HOA.

However, once you purchase your home, it’s important to keep a copy of the HOA’s conditions handy to reference as needed. It will outline everything you need to know, including what your fees cover. Typically, HOA fees cover the following types of things.

1. Maintenance And Repairs Of Shared Areas

The most common thing HOA fees cover is maintenance of the common areas in the community. You won’t have to worry about things like pest control, repairs, landscaping, or routine upkeep in these areas. For example, parking lots, a clubhouse, pool, fitness center, or any other shared places get taken care of with HOA fees.

HOA fees do not cover the maintenance or repairs of your home’s exterior. Your personal landscaping and any necessary repairs to the roof or other parts of your house are up to you.

A HOA is different from a COA (Condo Owners Association). If you own a condo, the COA typically handles everything outside your unit, and you are responsible for everything inside.

2. Municipal Services

Your HOA fees should also cover certain services like trash removal and water. Depending on the community, your fees may also cover security, such as neighborhood cameras, gated entry with a guard, or motion sensor lights.

3. The HOA’s Insurance

A portion of your HOA fees goes toward the insurance premiums the Homeowner Association needs to pay for coverage of common spaces. This insurance is not the same as your individual policy that you carry on your home. It covers damages or liabilities incurred in shared areas, sidewalks, roads, etc.

4. Amenities

Not all Homeowner Associations offer fancy amenities, therefore, this is an area that can make a big difference in what you pay. If you live in an HOA with tons of extras, like a fitness center, on-site security guard, a neighborhood playground, or a pool, you’ll pay more.

The HOA fees need to cover the costs to maintain and run these amenities. So, the more luxurious they are, the more your fees will be.

5. Reserve Funds

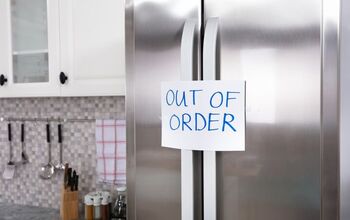

You probably know that life never goes quite like you think it will. Things always pop up unexpectedly. When it comes to homeownership, even when you practice regular maintenance, things break, wear down, or go kaput out of nowhere. This is why it’s wise to keep an emergency fund to handle unexpected repairs and other expenses.

Homeowner Associations do a similar thing. They maintain a reserve account, basically a savings account, to handle out-of-the-ordinary costs or larger-than-usual repairs. A portion of everyone’s HOA fees goes into this reserve fund to keep it growing.

If something major comes up, like replacing the HVAC in the clubhouse, the HOA dips into the reserve fund to cover it. However, if the expenses exceed the available amount in the fund, you might need to pay extra.

In this case, the HOA will send out special assessments. Therefore, it’s a wise idea to tuck away a little extra into your own home maintenance savings account to cover potential surprises.

How Much Are HOA Fees?

Different factors influence HOA fees, including location, the area’s average cost of living, types of homes, and included services and amenities. What you pay for HOA membership varies greatly depending on the community.

On average, HOA fees run about $300 a month. However, some people could pay less than $100 and other communities could charge over $1,000 monthly in HOA fees.

Since HOA fees vary so drastically, it’s important to get all of the information regarding them up front before you purchase a property. Make sure it’s clear exactly what the fees cover and also what restrictions are in place. Many Homeowner Associations impose strict guidelines for the exterior appearance of the neighborhood.

If you do anything to your home that goes against the desired aesthetics, you’ll get a warning to remove it or put it back to how it was. If you fail to comply, you end up paying a hefty amount in fines, and ultimately, you’ll need to make the changes anyway (or keep paying mounting fines).

What If I Don’t Pay My HOA Fees?

If you buy a house with an HOA, you must pay the HOA fees. Failing to do so comes with negative consequences, including fines, liens against your property, or foreclosure. Therefore, don’t forget to factor the HOA fees into your monthly housing costs to ensure you can truly afford the home.

When your HOA fees are due, if you fail to pay, you’ll typically receive a reminder to pay within thirty days. Most likely, this reminder will come with a late fee added to your usual fee amount. After 30 days, the HOA will take further action according to its rules.

The consequences usually include a fine and losing various privileges, such as no longer being able to use the pool or gym. The longer you don't pay, the worse it gets, with fines continuing to grow and the HOA pursuing legal action.

The HOA Could Sue You

Depending on how long you forego paying your HOA fees and applicable fines, you could face a lawsuit. If you lose the suit, you’ll have hefty legal fees added to your growing debt.

A Lien On Your Property

Another possibility of failing to pay your HOA fees is that the Homeowner Association puts a lien on your property. When there’s a lien on your property, you aren’t able to refinance or sell your home until you settle the debt. Even if you found a buyer willing to take over the lien, they’d struggle to find a lender willing to do the mortgage.

The only way to get the lien off your property is to pay the debt in full. Your HOA might be willing to set up a payment plan with you, but that’s up to their discretion.

Wrapping Up HOA Fees

When you’re already paying a mortgage, property taxes, and insurance for your home, adding HOA fees on top can be frustrating. However, once you understand everything those fees handle, it becomes a bit of an easier pill to swallow.

HOA fees typically cover maintenance and repairs of all shared spaces and insurance and municipal services for these areas. A portion of the fees also goes into a reserve fund to handle larger expenses and unexpected repairs.

But every HOA is different, and some cost more than others. Therefore, it’s up to you to read all the rules and codes to understand exactly what your fees cover. You also must be up to speed on how much penalty fees are if you don’t pay, and any issues that could lead to extra payments.

Related Guides:

Stacy Randall is a wife, mother, and freelance writer from NOLA that has always had a love for DIY projects, home organization, and making spaces beautiful. Together with her husband, she has been spending the last several years lovingly renovating her grandparent's former home, making it their own and learning a lot about life along the way.

More by Stacy Randall