How Much Should You Spend Per Year On Home Maintenance?

The cost of buying a home is only the tip of the iceberg when it comes to affordability. Maintenance costs are often unexpected, and they can leave many homeowners stressed and overwhelmed. So, how much should you spend per year on home maintenance?

You should spend at least 1% of your home’s value on home maintenance and repairs per year. Some homeowners must spend roughly 2% to 4% of their home’s value on maintenance per year. Homes older than 50 years require the most maintenance, and you should save at least $100 to $200 per month for repairs.

Home warranties help homeowners save money on maintenance, and they typically cost $800 per year. Every home is different, but preventative maintenance can help most homeowners save money on big repairs. Follow along as we explore how much you should spend per year on home maintenance.

How Much Should I Budget for Home Maintenance Per Year?

Ideally, you should budget at least 1% of your home’s value for maintenance per year. Many homeowners budget up to 2%, but that can be hard for some people to justify. Old homes require more maintenance in most cases, and you may need to spend up to 4% of the house’s value on maintenance.

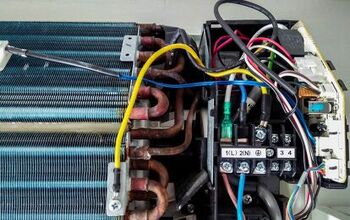

This amount may not always be a yearly expense, but you can expect to spend a small fortune on repairs for an old home at least once. Plumbing, roofing, and electrical work are the biggest reoccurring home maintenance costs.

Ideally, you should set aside at least $2,000 per year for maintenance if you bought a house worth $200,000. The easiest way to do this is to save $100 to $200 or more each month for emergencies and repairs.

How To Budget For Home Maintenance

Budgeting for home maintenance is all about timing. That includes everything from routine checkups on your appliances and plumbing fixtures to saving money from each paycheck. Let’s look at the best ways to budget for home maintenance so you don’t spend too much per year.

1. Evaluate Your Maintenance Needs

Every home is different and has unique maintenance needs. For example, newer homes are typically less prone to maintenance than older homes. Older homes are more likely to have roofing, electrical, and plumbing problems.

Because of that, if you have an older home, you should set aside more money for maintenance . That is especially true if your home is over 50 years old. Newer homes are prone to problems as well, but you won’t likely need to repair major plumbing or electrical problems any time soon.

The inspection process can tell you a lot about your home’s condition when you buy it. It’s important to carefully consider how much maintenance a home will need before you buy it. Pay attention to the appraiser and ask questions to understand the home’s condition. If you’ve already bought the house, hire a contractor or consultant to evaluate your house, and budget accordingly.

2. Save Before You Spend

The best way to budget for home maintenance is to save part of each check you receive from work. Put away enough each pay period so you save at least $100 per month for maintenance. Don’t forget that you may also have to replace important appliances in your house, such as the dishwasher or dryer.

That’s why it’s a great idea to set aside a bit more money than you may need for repairs. Your washing machine may fail the same week that you find a leak in your roof. Luckily, it’s easier than ever to save money without having to think about it.

For example, many banks and apps let you automatically transfer money to a separate account each week or month. You can always stop the transfer if you have an unexpected expense that’s unrelated to your home.

3. Invest In A Home Warranty

It’s not easy for everyone to set aside money for home repairs. Unexpected expenses often come up and make it hard to save money. Luckily, you can invest in a home warranty that will cover most of the repairs your home may need.

Home warranties typically cost $800 to $1,000 per year, but it depends on the provider. The warranty covers many basic maintenance needs, such as appliance repairs and plumbing. Your provider will send a technician to your house, and they will charge $70 to $100 per visit.

It may seem pricey, but you get plenty of bang for your buck if your house needs major repairs. This is a great alternative to budgeting by yourself.

4. Preventative Home Maintenance

Preventative home maintenance can help you prepare for the worst. The last thing you want to do is let your home fall into disrepair. Ideally, you should take preventative measures to make sure you can catch problems before they become too expensive.

Regularly check your appliances, gutters, and water heater for damage and debris. For example, you can save a fortune if you routinely clean your gutters. Gutters can eventually collapse if they become too clogged with debris.

It costs between $550 and $4,000 to replace gutters, so preventative maintenance is necessary. That said, you can’t prevent some issues, such as electrical problems in old homes. Make a checklist each week to inspect things around your home and take note of the condition of major areas. Remember to check for termites and bed bugs as well. It’s better to know a major repair is coming than to wake up to a problem.

5. Think About Your Home’s Size

It can be hard to budget for home maintenance based on your home’s value. That said, you can still save enough money for repairs if you think about your home’s size. Many homeowners simply budget $1 per square foot of their homes for repairs.

This isn’t quite as precise as budgeting based on your home’s value, however. That said, it’s a great option if you cannot justify setting aside hundreds of dollars each month. It’s better than nothing, and you’ll at least have a nest egg to cover expenses whenever repairs are necessary.

6. Consider The Resale Value

Do you plan to sell your house one day? If so, then it’s important to think about your home’s resale value. Basic maintenance can keep you afloat so you can get through problems that pop up unexpectedly.

However, some maintenance needs will only serve to add value to your house. Don’t think of your maintenance fees as a burden. Instead, think of the expenses as something that will help tremendously when it’s time to sell your house.

It’s worthwhile spending the money on repairs that will make it easier to sell your house later. For example, it can cost thousands of dollars to update your home’s wiring. However, it will also ensure that future buyers can’t ask for a lower price on your house because the wiring is outdated. Home maintenance is a worthwhile investment, even if it’s annoying at the time.

Summing It Up

The average homeowner spends roughly between 1% and 4% of their home’s value on maintenance per year. Ideally, you should set aside a few hundred dollars per month to cover expenses as they come up. Otherwise, it’s worthwhile to purchase a home warranty. A home warranty can help you save money on major home repairs, and it typically costs $800 per year.

Related Guides:

Nick Durante is a professional writer with a primary focus on home improvement. When he is not writing about home improvement or taking on projects around the house, he likes to read and create art. He is always looking towards the newest trends in home improvement.

More by Nick Durante

![10 Best Scroll Saws for 2022 [Ultimate Reviews & Buyer's Guide]](https://cdn-fastly.upgradedhome.com/media/2023/07/31/9070684/10-best-scroll-saws-for-2022-ultimate-reviews-buyer-s-guide.jpg?size=350x220)

![How Much Weight Can a 4×4 Support Horizontally? [It Depends!]](https://cdn-fastly.upgradedhome.com/media/2023/07/31/9070333/how-much-weight-can-a-44-support-horizontally-it-depends.jpg?size=350x220)