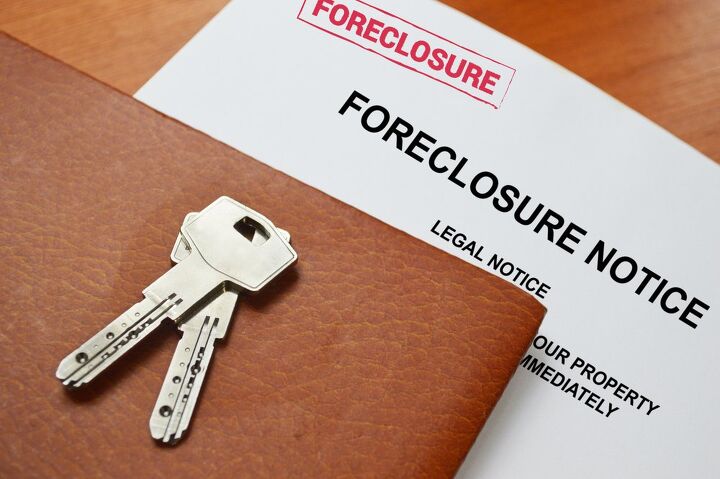

How To Stop Eviction After Foreclosure [Step-by-Step Instructions]

Economic hardship can hit anyone. Often, people who have been in a good financial situation find themselves without a job or with a significantly lower-paying job. As circumstances change, our ability to pay for housing changes as well. If you have a mortgage with a monthly payment that you can no longer afford, you may be facing foreclosure and eviction.

If you find yourself unable to continue paying your mortgage, the best way to avoid both foreclosure and eviction is to sell the property before the foreclosure is completed. That way you can return the borrowed money to the lender without facing legal proceedings.

Other options include paying back the missed payments, applying for financial assistance through government agencies, moving out voluntarily, or negotiating with the new owner to remain as a tenant.

Continue on to understand what foreclosure and eviction are, the legal ramifications of being evicted, and possibilities you can pursue to avoid being evicted.

Do You Need to Hire Movers?

Get free, zero-commitment quotes from pro contractors near you.

How to Delay or Avoid Eviction after a Foreclosure Sale?

After a foreclosure sale, someone has purchased the house and is now the legal owner. You will have to move out of the house, but you can make it easier or harder on yourself with the actions you choose to take. Forced eviction is a negative on your legal record and credit rating.

Redemption Period

If the bank sells the house at a foreclosure auction, you cannot be evicted until the sale is closed. In some states, you are allowed a redemption period after the sale when you can repay the loan and other fees in total and still maintain ownership of the house.

Negotiate a Move-Out Date

You can keep from being evicted by negotiating a move-out date with the new owner. If the new owner has to file a legal injunction to force you out of the property, it may make it more complicated for you to rent a home in the future. The legal injunction will also negatively affect your credit score, so you should avoid legal eviction if at all possible.

Negotiate a Rental Agreement

One possibility is negotiating with the new owners to see if you can continue to live in the house as a tenant while you arrange for a new living situation.

Cash for Keys

Some new purchasers may offer the current residents “cash for keys.” It is an opportunity to allow the current residents to move out without legal injunction and with a little bit of money to help them arrange a new place to live.

What is Foreclosure?

When you purchase a home, you generally have to borrow most of the money to pay for it, sometimes hundreds of thousands of dollars. Most people take between 15 and 30 years to pay the total of the house. The house itself becomes the collateral for the loan.

If you cannot make the payments on the house, the bank that holds the mortgage has the right to take over ownership of your house after a certain amount of time, at least 90 days. When the bank takes possession of the house, it will put the house up for sale to recoup their losses and you will be evicted.

Foreclosure is a Slow Process

If you are just a few days late on your mortgage payment, you won’t be facing eviction, but you will accrue late fees. You should always contact the lender as soon as possible when you are having difficulty paying the mortgage.

If you miss payments, the lender will start by mailing or e-mailing you notices that your payment has been missed. After three missed payments you will be considered to have defaulted on the loan. At this point, the lender can start the foreclosure process by notifying you of their intent in writing.

Foreclosures will damage your credit score. It can make it difficult for you to rent or buy a home for the next seven years. The foreclosure reporting on your credit score can also make it difficult to get a loan of any kind in the years following the foreclosure.

What is Eviction as it Relates to Foreclosure?

Eviction is legal removal from a house for failure to make payments on a mortgage loan. Eviction laws vary from state to state, but in general, the owners whether it is the bank or a private owner must give the person living there a certain amount of time to move out.

The owners must provide the residents notice that they are being evicted and the number of days they have to vacate the property. If the resident does not move out, the owner can bring in a Sheriff or other law enforcement personnel to enforce the move.

Unlike foreclosure, eviction doesn’t show up on your credit score. However, it does show up in legal reports, and it may become difficult for you to rent in the future. Because the legal judgment against you can show up on consumer reports, you may also be denied a loan or credit card.

Both foreclosures and evictions remain matters of public record for seven years.

How to Delay Foreclosure and Eviction?

After you have missed several payments on a mortgage, the lender can begin foreclosure proceedings. They will send you several notices informing you that you are late on the payments. The number of notices and precisely what they say will vary based on the bank and the state you live in, so be sure to carefully read the information

Refinance Your Home

One possibility for changing the amount of your monthly mortgage payments in refinancing your home. Before you default on your loan and take a hit to your credit rating, shop around for a new lender to refinance the home at a lower interest rate. This will reduce your monthly payment, allow you to stay in the home, and keep your credit score intact.

If you cannot lower the interest rate, you might be able to extend the payment period from 15 to 30 years. This will also reduce the monthly payment. However, you will end up paying more in the long run due to interest charges.

Contact your Lender

If you are behind on your mortgage payments, you should contact your lender or bank and discuss a different payment schedule with them. It is possible that they might take a lower payment for a few months until you can return to making the regularly scheduled payments.

They may also give you extra time to repay the amount you are behind on. Make every effort to catch up on your payments so that you can retain ownership of your home.

Consult with a Lawyer

You should consult with a lawyer to ensure that you understand all of the conditions in your original mortgage and the penalties of not repaying paying the late payments on time. Be sure that the lawyer you meet with has experience in real estate law.

Apply for Governmental Assistance

You may also be able to apply for financial assistance through the Making Homes Affordable program. In addition, you can look for a foreclosure counselor in your state through the U.S. Department of Housing and Urban Development. If the loan you have is an FHA loan, you can call the FHA National Servicing Center at 1-877-622-8525 for assistance with your mortgage.

File for Bankruptcy

Filing for bankruptcy is a complex, time-consuming process. However, if this is the path you choose, you should start it as soon as possible and work with a lawyer specializing in bankruptcy law.

If you expect to file for bankruptcy, do so before the lender or bank forecloses on the property or serves you a notice of eviction. This will buy you some time to catch up on the payments that you have missed and make arrangements for future payments.

Sell the House

If you are unable to continue payments on your mortgage, you should attempt to sell your home at this time. Foreclosure to your home will ruin your credit rating. Selling your home will be a way to pay back your mortgage without going into foreclosure.

Foreclosure Auction

After the bank or lender has notified you of missed payments for at least 90 days, they can offer the house for sale at an auction. Their goal is to accept the highest bid for it and regain as much of their lost capital as possible. Homes often sell for 20-40% less than the market value of the house.

If no one offers the minimum amount that the bank wants, then the homeownership goes to the bank. It will likely be put up for sale at the next auction. You should take the extra time to hire a foreclosure attorney to help you make decisions about your situation.

Do You Need to Hire Movers?

Get free, zero-commitment quotes from pro contractors near you.

Final Words

If economic difficulties have forced you to miss mortgage payments, and you are facing foreclosure and eviction, you should try to sell the house in order to regain as much of the balance of the loan as possible. This way you can pay off the loan so that the default does not affect your credit score or your legal history. You can apply for financial assistance from the Making Homes Affordable Project and the U.S. Government’s Housing and Urban Development Programs.

If you are unable to sell the property, you should negotiate a move-out date with the new owners so that you do not have a legal eviction on your record, because it could impact your ability to rent or get a loan in the future.

We are a team of passionate homeowners, home improvement pros, and DIY enthusiasts who enjoy sharing home improvement, housekeeping, decorating, and more with other homeowners! Whether you're looking for a step-by-step guide on fixing an appliance or the cost of installing a fence, we've here to help.

More by Upgraded Home Team

![The 5 Best Angle Grinders – [2022 Reviews & Buyer's Guide]](https://cdn-fastly.upgradedhome.com/media/2023/07/31/9071326/the-5-best-angle-grinders-2022-reviews-buyer-s-guide.jpg?size=350x220)

![Finishing Basement Without Permit [Is It Really Illegal?]](https://cdn-fastly.upgradedhome.com/media/2023/07/31/9070078/finishing-basement-without-permit-is-it-really-illegal.jpg?size=350x220)